Have you been claiming your kid as a dependent since they were in Pampers? If yes, read on…

Now your child just got their first job and is earning an income. Great news: you won’t have to pay them a weekly allowance for the sub-par chores they keep complaining about anymore. Not-so-good news: they’ve entered into the big bad world of taxes!

Don’t worry…it’s not that scary. Really. In fact, in some cases, your child may not even need to file their own tax return yet.

Let’s take a closer look.

Should you report the income they’re now earning on your own return?

You can’t and you won’t. Plain and simple, you will never report any income your dependent earned on your own tax return.

Take Frankie for example:

Frankie is 16 years old and was hired for the summer as an assistant camp councilor. He will be earning a little under $4,000 for the three months he is employed. When tax time rolls around, Frankie determined that he will not need to file a tax return of his own and will still be claimed as a dependent on his parent’s return. Although his parents are claiming him as a dependent, they will not report Frankie’s $4,000 summer income.

As seen in the example , although you cannot report the income they’re earning on your tax return, you can still claim them as a dependent.

How about their unearned income?

Unlike income earned from work, you can report your dependent’s so-called unearned income, such as income from interest and dividends or capital gains distribution, on your own tax return but only up to a certain amount. If the child’s unearned income exceeds that amount, then they will need to file their own tax return and specify that they are being claimed as a dependent.

Sticking with Frankie,

Let’s say his parents purchased 3 savings bonds in Frankie’s name when he was a toddler. From the time of purchase, those savings bonds have accumulated interest each year. That interest is considered Frankie’s ‘unearned income’. His parents can elect to report that interest on their own tax return under certain guidelines and as long as they are claiming Frankie as a dependent.

In a nutshell, a parent or guardian can only report their dependent child’s unearned income if ALL of the following IRS rules apply:

- the child’s total unearned income is between $1,000 and $10,500

- the child made no estimated payments to the IRS during the year

- the child had no income tax withheld by their employer

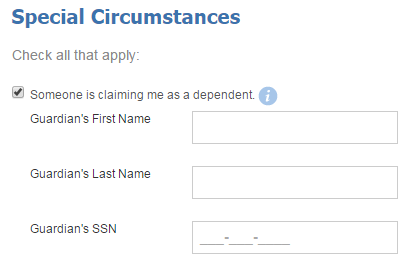

If any of the above do not apply, then the dependent child will need to file their own tax return and specify that they are being claimed as a dependent. On the PriorTax website, it will look like this:

Reporting your child’s income could affect your tax return negatively!

Sure, it eliminates the cost of filing a separate tax return to report the unearned income but there are some disadvantages that you should be aware of. If you report your child’s unearned income on your tax return, you risk a higher tax liability. This is because reporting more income will increase your adjusted gross income. Your adjusted gross income is a key player in how high or low your tax bill turns out to be. The AGI also has an effect on certain credits you can claim.

To see if reporting your dependent’s unearned income will pay off, complete the income section on your PriorTax account with the reported unearned income and then again, without it. You can then compare the numbers and see if it drastically changes your refund or the tax you owe.

Bottom line: logic is not always the best tool in tax matters.

Reporting dependent income may seem like the logical thing to do. After all, you have been claiming them on your taxes since the day they were born. However, much like with everything tax-related, there are rules that say otherwise. Let the PriorTax team help you answer these questions via free live chat, email and phone support.